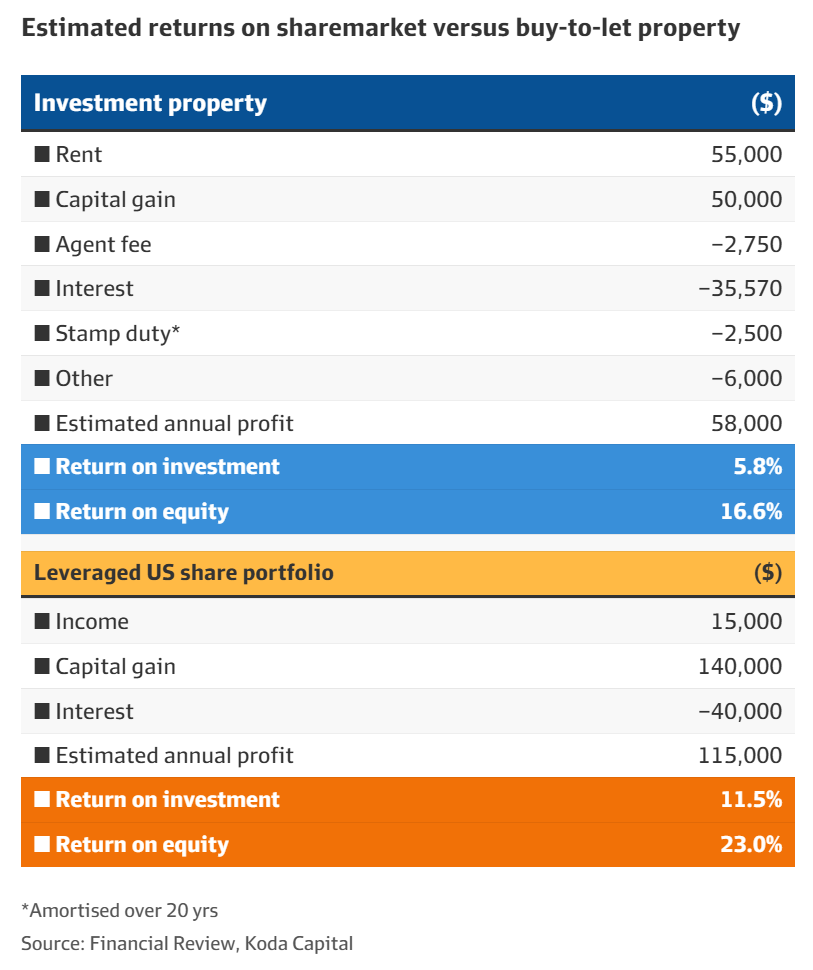

On 15 March 2024 journalist Tony Richardson wrote an interesting article “The ‘better way’ to build wealth than property investing” about Koda Capital financial adviser Sebastian Ferrando’s opinion that building wealth through levered equities is better than levered property. Their table and selected quotes are presented below:

Typical buy-to-let investors in Brisbane, Sydney or Melbourne will pay a deposit of 35 per cent and borrow 65 per cent from a lender…

The basic investment thesis is that buy-to-let investors can profit from leverage as they can make returns in the form of rent and capital growth on a $1 million asset after spending $350,000.

But Ferrando says anyone with savings beyond those needed to own a primary place of residence could also obtain leverage – known as a margin facility – on a share portfolio with a broker.

Take a hypothetical $1 million share portfolio with $500,000 committed by the investor and $500,000 committed by a broker on margin (accruing interest to be repaid). It could return 11.5 per cent a year after the interest paid on the margin debt and assuming an average return of 14 per cent per year, split across the Nasdaq and S&P 500. (Richardson, 2024)

Assume a 4% pa risk free rate, 6% pa market risk premium (MRP), fairly priced property, stock and debt, ignore all taxes (except stamp duty) and currency differences, assume a single factor international CAPM. All figures are given to 6 decimal places.

Which of the following statements is NOT correct? The: