| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Correlation | Beta | Dollars invested |

|

| A | 0.2 | 0.4 | 0.12 | 0.5 | 40 | |

| B | 0.3 | 0.8 | 1.5 | 80 | ||

What is the beta of the above portfolio?

| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Covariance (σA,B) | Beta | Dollars invested |

|

| A | 0.2 | 0.4 | 0.12 | 0.5 | 40 | |

| B | 0.3 | 0.8 | 1.5 | 80 | ||

What is the standard deviation (not variance) of the above portfolio? Note that the stocks' covariance is given, not correlation.

| Portfolio Details | ||||||

| Stock | Expected return |

Standard deviation |

Correlation (ρA,B) | Dollars invested |

||

| A | 0.1 | 0.4 | 0.5 | 60 | ||

| B | 0.2 | 0.6 | 140 | |||

What is the standard deviation (not variance) of returns of the above portfolio?

All things remaining equal, the variance of a portfolio of two positively-weighted stocks rises as:

Three important classes of investable risky assets are:

- Corporate debt which has low total risk,

- Real estate which has medium total risk,

- Equity which has high total risk.

Assume that the correlation between total returns on:

- Corporate debt and real estate is 0.1,

- Corporate debt and equity is 0.1,

- Real estate and equity is 0.5.

You are considering investing all of your wealth in one or more of these asset classes. Which portfolio will give the lowest total risk? You are restricted from shorting any of these assets. Disregard returns and the risk-return trade-off, pretend that you are only concerned with minimising risk.

Two risky stocks A and B comprise an equal-weighted portfolio. The correlation between the stocks' returns is 70%.

If the variance of stock A's returns increases but the:

- Prices and expected returns of each stock stays the same,

- Variance of stock B's returns stays the same,

- Correlation of returns between the stocks stays the same.

Which of the following statements is NOT correct?

All things remaining equal, the higher the correlation of returns between two stocks:

Question 408 leverage, portfolio beta, portfolio risk, real estate, CAPM

You just bought a house worth $1,000,000. You financed it with an $800,000 mortgage loan and a deposit of $200,000.

You estimate that:

- The house has a beta of 1;

- The mortgage loan has a beta of 0.2.

What is the beta of the equity (the $200,000 deposit) that you have in your house?

Also, if the risk free rate is 5% pa and the market portfolio's return is 10% pa, what is the expected return on equity in your house? Ignore taxes, assume that all cash flows (interest payments and rent) were paid and received at the end of the year, and all rates are effective annual rates.

The accounting identity states that the book value of a company's assets (A) equals its liabilities (L) plus owners equity (OE), so A = L + OE.

The finance version states that the market value of a company's assets (V) equals the market value of its debt (D) plus equity (E), so V = D + E.

Therefore a business's assets can be seen as a portfolio of the debt and equity that fund the assets.

Let σ2V total be the total variance of returns on assets, σ2V syst be the systematic variance of returns on assets, and σ2V idio be the idiosyncratic variance of returns on assets, and ρD idio, E idio be the correlation between the idiosyncratic returns on debt and equity.

Which of the following equations is NOT correct?

Question 556 portfolio risk, portfolio return, standard deviation

An investor wants to make a portfolio of two stocks A and B with a target expected portfolio return of 12% pa.

- Stock A has an expected return of 10% pa and a standard deviation of 20% pa.

- Stock B has an expected return of 15% pa and a standard deviation of 30% pa.

The correlation coefficient between stock A and B's expected returns is 70%.

What will be the annual standard deviation of the portfolio with this 12% pa target return?

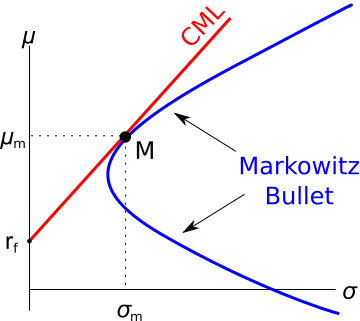

Question 778 CML, systematic and idiosyncratic risk, portfolio risk, CAPM

The capital market line (CML) is shown in the graph below. The total standard deviation is denoted by σ and the expected return is μ. Assume that markets are efficient so all assets are fairly priced.

Which of the below statements is NOT correct?

Question 800 leverage, portfolio return, risk, portfolio risk, capital structure, no explanation

Which of the following assets would you expect to have the highest required rate of return? All values are current market values.