Question 749 Multiples valuation, PE ratio, price to revenue ratio, price to book ratio, NPV

A real estate agent says that the price of a house in Sydney Australia is approximately equal to the gross weekly rent times 1000.

What type of valuation method is the real estate agent using?

Question 959 negative gearing, leverage, capital structure, interest tax shield, real estate

Last year, two friends Gear and Nogear invested in residential apartments. Each invested $1 million of their own money (their net wealth).

Apartments cost $1,000,000 last year and they earned net rents of $30,000 pa over the last year. Net rents are calculated as rent revenues less the costs of renting such as property maintenance, land tax and council rates. However, interest expense and personal income taxes are not deducted from net rents.

Gear and Nogear funded their purchases in different ways:

- Gear used $1,000,000 of her own money and borrowed $4,000,000 from the bank in the form of an interest-only loan with an interest rate of 5% pa to buy 5 apartments.

- Nogear used $1,000,000 of his own money to buy one apartment. He has no mortgage loan on his property.

Both Gear and Nogear also work in high-paying jobs and are subject personal marginal tax rates of 45%.

Which of the below statements about the past year is NOT correct?

Which of the following statements about call options is NOT correct?

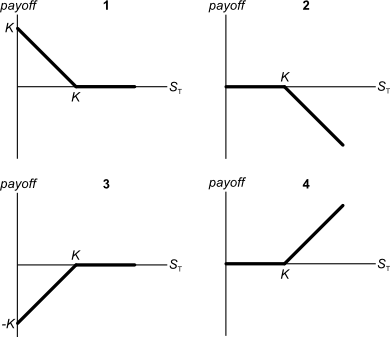

Below are 4 option graphs. Note that the y-axis is payoff at maturity (T). What options do they depict? List them in the order that they are numbered.

You intend to use futures on oil to hedge the risk of purchasing oil. There is no cross-hedging risk. Oil pays no dividends but it’s costly to store. Which of the following statements about basis risk in this scenario is NOT correct?

Question 790 mean and median returns, return distribution, arithmetic and geometric averages, continuously compounding rate, log-normal distribution, VaR, confidence interval

A risk manager has identified that their hedge fund’s continuously compounded portfolio returns are normally distributed with a mean of 10% pa and a standard deviation of 30% pa. The hedge fund’s portfolio is currently valued at $100 million. Assume that there is no estimation error in these figures and that the normal cumulative density function at 1.644853627 is 95%.

Which of the following statements is NOT correct? All answers are rounded to the nearest dollar.

A company has a 95% daily Value at Risk (VaR) of $1 million. The units of this VaR are in: