Value the following business project to manufacture a new product.

| Project Data | ||

| Project life | 2 yrs | |

| Initial investment in equipment | $6m | |

| Depreciation of equipment per year | $3m | |

| Expected sale price of equipment at end of project | $0.6m | |

| Unit sales per year | 4m | |

| Sale price per unit | $8 | |

| Variable cost per unit | $5 | |

| Fixed costs per year, paid at the end of each year | $1m | |

| Interest expense per year | 0 | |

| Tax rate | 30% | |

| Weighted average cost of capital after tax per annum | 10% | |

Notes

- The firm's current assets and current liabilities are $3m and $2m respectively right now. This net working capital will not be used in this project, it will be used in other unrelated projects.

Due to the project, current assets (mostly inventory) will grow by $2m initially (at t = 0), and then by $0.2m at the end of the first year (t=1).

Current liabilities (mostly trade creditors) will increase by $0.1m at the end of the first year (t=1).

At the end of the project, the net working capital accumulated due to the project can be sold for the same price that it was bought. - The project cost $0.5m to research which was incurred one year ago.

Assumptions

- All cash flows occur at the start or end of the year as appropriate, not in the middle or throughout the year.

- All rates and cash flows are real. The inflation rate is 3% pa.

- All rates are given as effective annual rates.

- The business considering the project is run as a 'sole tradership' (run by an individual without a company) and is therefore eligible for a 50% capital gains tax discount when the equipment is sold, as permitted by the Australian Tax Office.

What is the expected net present value (NPV) of the project?

Question 370 capital budgeting, NPV, interest tax shield, WACC, CFFA

| Project Data | ||

| Project life | 2 yrs | |

| Initial investment in equipment | $600k | |

| Depreciation of equipment per year | $250k | |

| Expected sale price of equipment at end of project | $200k | |

| Revenue per job | $12k | |

| Variable cost per job | $4k | |

| Quantity of jobs per year | 120 | |

| Fixed costs per year, paid at the end of each year | $100k | |

| Interest expense in first year (at t=1) | $16.091k | |

| Interest expense in second year (at t=2) | $9.711k | |

| Tax rate | 30% | |

| Government treasury bond yield | 5% | |

| Bank loan debt yield | 6% | |

| Levered cost of equity | 12.5% | |

| Market portfolio return | 10% | |

| Beta of assets | 1.24 | |

| Beta of levered equity | 1.5 | |

| Firm's and project's debt-to-equity ratio | 25% | |

Notes

- The project will require an immediate purchase of $50k of inventory, which will all be sold at cost when the project ends. Current liabilities are negligible so they can be ignored.

Assumptions

- The debt-to-equity ratio will be kept constant throughout the life of the project. The amount of interest expense at the end of each period has been correctly calculated to maintain this constant debt-to-equity ratio. Note that interest expense is different in each year.

- Thousands are represented by 'k' (kilo).

- All cash flows occur at the start or end of the year as appropriate, not in the middle or throughout the year.

- All rates and cash flows are nominal. The inflation rate is 2% pa.

- All rates are given as effective annual rates.

- The 50% capital gains tax discount is not available since the project is undertaken by a firm, not an individual.

What is the net present value (NPV) of the project?

Four retail business people compete in the same city. They are all exactly the same except that they have different ways of funding or leasing the shop real estate needed to run their retail business.

The two main assets that retail stores need are:

- Inventory typically worth $1 million which has a beta of 2, and;

- Shopfront real estate worth $1 million which has a beta of 1. Shops can be bought or leased.

Lease contract prices are fixed for the term of the lease and based on expectations of the future state of the economy. When leases end, a new lease contract is negotiated and the lease cost may be higher or lower depending on the state of the economy and demand and supply if the economy is:

- Booming, shop real estate is worth more and lease costs are higher.

- In recession, shop real estate is worth less and lease costs are low.

Which retail business person will have the LOWEST beta of equity (or net wealth)?

A firm has a debt-to-assets ratio of 50%. The firm then issues a large amount of debt to raise money for new projects of similar market risk to the company's existing projects. Assume a classical tax system. Which statement is correct?

Question 772 interest tax shield, capital structure, leverage

A firm issues debt and uses the funds to buy back equity. Assume that there are no costs of financial distress or transactions costs. Which of the following statements about interest tax shields is NOT correct?

Question 802 negative gearing, leverage, capital structure, no explanation

Which of the following statements about ‘negative gearing’ is NOT correct?

Question 941 negative gearing, leverage, capital structure, interest tax shield, real estate

Last year, two friends Lev and Nolev each bought similar investment properties for $1 million. Both earned net rents of $30,000 pa over the past year. They funded their purchases in different ways:

- Lev used $200,000 of his own money and borrowed $800,000 from the bank in the form of an interest-only loan with an interest rate of 5% pa.

- Nolev used $1,000,000 of his own money, he has no mortgage loan on his property.

Both Lev and Nolev also work in high-paying jobs and are subject personal marginal tax rates of 45%.

Which of the below statements about the past year is NOT correct?

An analyst is valuing a levered company whose owners insist on keeping a constant market debt to assets ratio into the future.

The analyst is wondering how asset values and other things in her model will change when she changes the forecast sales growth rate.

Which of the below values will increase as the forecast growth rate of sales increases, with the debt to assets ratio remaining constant?

Assume that the cost of debt (yield) remains constant and the company’s asset beta will also remain constant since any expansion (or downsize) will involve buying (or selling) more of the same assets.

The analyst should expect which value or ratio to increase when the forecast growth rate of sales increases and the debt to assets ratio remains unchanged? In other words, which of the following values will NOT remain constant?

Question 1039 gross domestic product, inflation, business cycle

In this business cycle graph shown in the RBA's article explaining recessions, how might 'output' on the y-axis be measured?

The ‘output’ y-axis amount in the business cycle chart can be measured by:

Question 852 gross domestic product, inflation, employment, no explanation

When the economy is booming (in an upswing), you tend to see:

Question 841 gross domestic product, government spending

The government spends money on:

- Goods and services such as defence, police, schools, hospitals and roads; and

- Transfer payments (also called welfare) such as the pension, dole, disability support and student support.

When calculating GDP (=C+I+G+X-M), the ‘government spending’ component (G) is supposed to include:

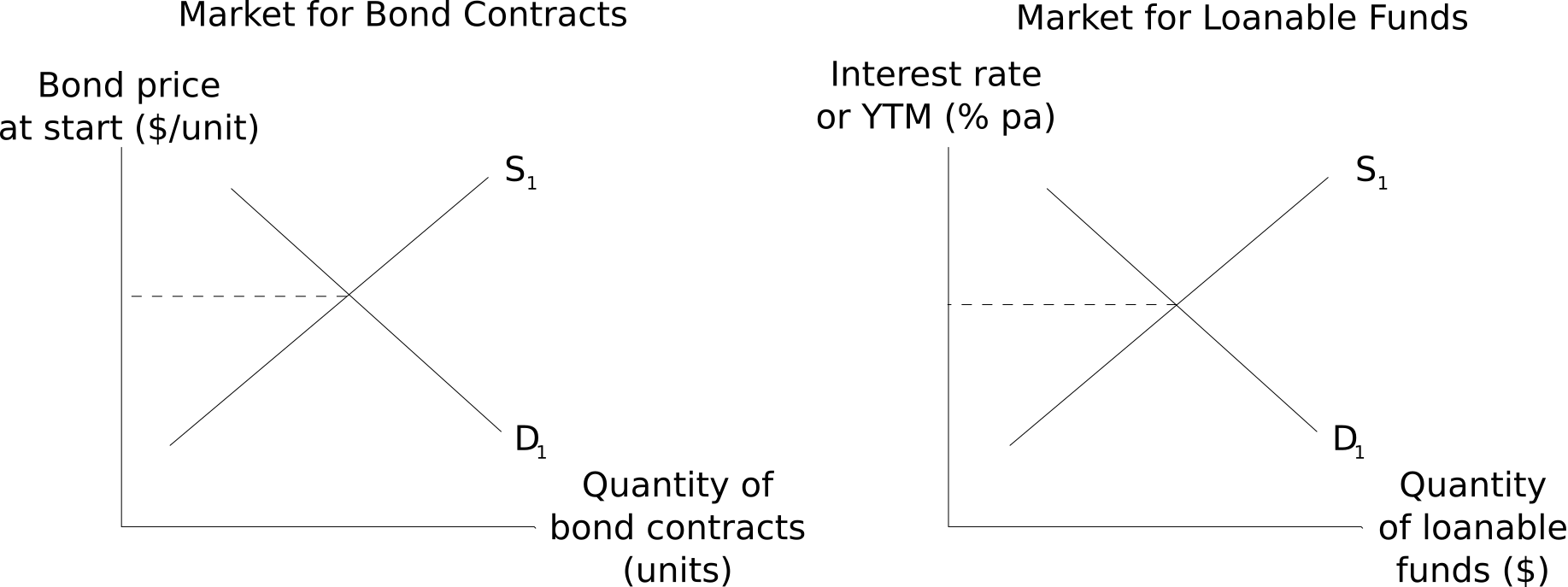

Question 1053 bond pricing, monetary policy, supply and demand

In his 31 August 2021 article 'The rich get richer and rates get lower', Robert Armstrong states that: "Savings chase returns, so when there are more savings and the same number of places to put them, rates of return must fall" (Armstrong, 2021).

Another way of saying that "rates of return must fall" when there are more savings (loanable funds) invested into fixed coupon government and corporate bonds, is that increased:

Question 1013 book build, initial public offering, capital raising, demand schedule

A firm is floating its stock in an IPO and its underwriter has received the following bids, listed in order from highest to lowest share price:

| IPO Book Build Bids | ||

| Bidders | Share price | Number of shares |

| $/share | millions | |

| BidderA | 2.5 | 2 |

| BidderB | 2 | 1.5 |

| BidderC | 1.5 | 4 |

| BidderD | 1 | 3 |

| BidderE | 0.5 | 2 |

Suppose that the firm's owner wishes to sell all of their 8 million shares, so no new money will be raised and no money will re-invested back into the firm. Which of the following statements is NOT correct?

Question 1014 book build, initial public offering, capital raising, demand schedule

A firm is floating its stock in an IPO and its underwriter has received the following bids, listed in order from highest to lowest share price:

| IPO Book Build Bids | ||

| Bidders | Share price | Number of shares |

| $/share | millions | |

| BidderA | 2.5 | 2 |

| BidderB | 2 | 1.5 |

| BidderC | 1.5 | 4 |

| BidderD | 1 | 3 |

| BidderE | 0.5 | 2 |

Suppose that the firm's owner wishes to raise $6 million to expand the business by selling new stock in the initial public offering (IPO). The owner currently holds 8 million stock which are not for sale. Which of the following statements is NOT correct?

Question 625 dividend re-investment plan, capital raising

Which of the following statements about dividend re-investment plans (DRP's) is NOT correct?

Question 1009 lemons problem, asymmetric information, adverse selection

Akerlof’s 1970 paper ‘The Market for "Lemons": Quality Uncertainty and the Market Mechanism’ provides a famous example of asymmetric information leading to market failure. This example is commonly known as the ‘Lemons Problem’. Imagine that half of all second hand cars are:

- Lemons worth $5,000 each. Lemons are bad second-hand cars with hidden faults that only the seller knows about; and the other half are

- Plums worth $10,000 each. Plums are good second-hand cars without faults.

Car buyers can’t tell the difference between lemon and plum cars.

Car sellers know whether their car is a lemon or a plum since they’ve driven the car for a long time. However, plum car owners cannot prove their cars’ higher quality to buyers. Also, lemon car owners are known to dis-honestly claim that their cars are plums.

What will be the market price of second hand cars?

Question 1012 moral hazard, principal agent problem, asymmetric information

When does the ‘principal-agent problem’ occur? Is it when:

I. The principal has conflicting incentives (moral hazard);

II. The agent has conflicting incentives (moral hazard);

III. The principal has incomplete information about the agent (asymmetric information); or

IV. The agent has incomplete information about the principal (asymmetric information)?

The principal-agent problem occurs when the following statements are true:

A levered firm has only 2 assets on its balance sheet with the below market values and CAPM betas. The risk free rate is 3% pa and the market risk premium is 5% pa. Assume that the CAPM is correct and all assets are fairly priced.

| Balance Sheet Market Values and Betas | ||

| Balance sheet item | Market value ($m) | Beta |

| Cash asset | 0.5 | 0 |

| Truck assets | 0.5 | 2 |

| Loan liabilities | 0.25 | 0.1 |

| Equity funding | ? | ? |

Which of the following statements is NOT correct?

Which of the following statements about option contracts is NOT correct? For every:

After doing extensive fundamental analysis of a company, you believe that their shares are overpriced and will soon fall significantly. The market believes that there will be no such fall.

Which of the following strategies is NOT a good idea, assuming that your prediction is true?

Which of the below formulas gives the profit (π) from being short a call option? Let the underlying asset price at maturity be ST, the exercise price be XT and the option price be fLC,0. Note that ST, XT and fLC,0 are all positive numbers.

Question 584 option, option payoff at maturity, option profit

Which of the following statements about European call options on non-dividend paying stocks is NOT correct?

Being long a call and short a put which have the same exercise prices and underlying stock is equivalent to being:

A stock, a call, a put and a bond are available to trade. The call and put options' underlying asset is the stock they and have the same strike prices, KT.

You are currently long the stock. You want to hedge your long stock position without actually trading the stock. How would you do this?