A project to build a toll road will take 3 years to complete, costing three payments of $50 million, paid at the start of each year (at times 0, 1, and 2).

After completion, the toll road will yield a constant $10 million at the end of each year forever with no costs. So the first payment will be at t=4.

The required return of the project is 10% pa given as an effective nominal rate. All cash flows are nominal.

What is the payback period?

A three year project's NPV is negative. The cash flows of the project include a negative cash flow at the very start and positive cash flows over its short life. The required return of the project is 10% pa. Select the most correct statement.

The required return of a project is 10%, given as an effective annual rate.

What is the payback period of the project in years?

Assume that the cash flows shown in the table are received smoothly over the year. So the $121 at time 2 is actually earned smoothly from t=1 to t=2.

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 11 |

| 2 | 121 |

A project has the following cash flows. Normally cash flows are assumed to happen at the given time. But here, assume that the cash flows are received smoothly over the year. So the $250 at time 2 is actually earned smoothly from t=1 to t=2:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -400 |

| 1 | 200 |

| 2 | 250 |

What is the payback period of the project in years?

A project's NPV is positive. Select the most correct statement:

A project has the following cash flows:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -400 |

| 1 | 0 |

| 2 | 500 |

What is the payback period of the project in years?

Normally cash flows are assumed to happen at the given time. But here, assume that the cash flows are received smoothly over the year. So the $500 at time 2 is actually earned smoothly from t=1 to t=2.

A project's Profitability Index (PI) is less than 1. Select the most correct statement:

A project has the following cash flows. Normally cash flows are assumed to happen at the given time. But here, assume that the cash flows are received smoothly over the year. So the $105 at time 2 is actually earned smoothly from t=1 to t=2:

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -90 |

| 1 | 30 |

| 2 | 105 |

What is the payback period of the project in years?

A mature firm has constant expected future earnings and dividends. Both amounts are equal. So earnings and dividends are expected to be equal and unchanging.

Which of the following statements is NOT correct?

A firm is considering a business project which costs $11m now and is expected to pay a constant $1m at the end of every year forever.

Assume that the initial $11m cost is funded using the firm's existing cash so no new equity or debt will be raised. The cost of capital is 10% pa.

Which of the following statements about net present value (NPV), internal rate of return (IRR) and payback period is NOT correct?

A firm is considering a business project which costs $10m now and is expected to pay a single cash flow of $12.1m in two years.

Assume that the initial $10m cost is funded using the firm's existing cash so no new equity or debt will be raised. The cost of capital is 10% pa.

Which of the following statements about net present value (NPV), internal rate of return (IRR) and payback period is NOT correct?

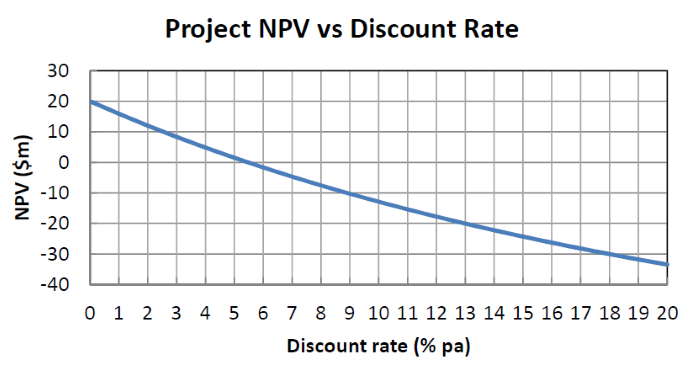

The below graph shows a project's net present value (NPV) against its annual discount rate.

Which of the following statements is NOT correct?

A stock is expected to pay a dividend of $1 in one year. Its future annual dividends are expected to grow by 10% pa. So the first dividend of $1 is in one year, and the year after that the dividend will be $1.1 (=1*(1+0.1)^1), and a year later $1.21 (=1*(1+0.1)^2) and so on forever.

Its required total return is 30% pa. The total required return and growth rate of dividends are given as effective annual rates. The stock is fairly priced.

Calculate the pay back period of buying the stock and holding onto it forever, assuming that the dividends are received as at each time, not smoothly over each year.

You're considering a business project which costs $11m now and is expected to pay a single cash flow of $11m in one year. So you pay $11m now, then one year later you receive $11m.

Assume that the initial $11m cost is funded using the your firm's existing cash so no new equity or debt will be raised. The cost of capital is 10% pa.

Which of the following statements about the net present value (NPV), internal rate of return (IRR) and payback period is NOT correct?

Your 18 year old friend is considering what to do with their working life until they retire at age 65. They've sought your advice.

For simplicity, ignore taxes and assume that wages will be paid annually in arrears and will be constant (zero growth). The abbreviation 'k' (Greek kilo) means thousands, so 1k is 1000.

Let the present be time zero (t=0) and the year that you retire be time 47 (t=47).

Your friend is deciding between working as a:

- Builder's apprentice for 2 years earning $20k pa (2 payments from t=1 to t=2 inclusive), then beginning work as a builder for $90k pa (45 annual payments from t=3 to 47 inclusive);

- Retail shop salesperson for $50k pa (47 payments from t=1 to t=47 inclusive).

You estimate that the required return is 5% pa with either career, and that they're equally risky. The cashflows are shown below:

| Career Choices and Cash Flows | ||

| Time | Builder | Retailer |

| 0 | 0 | 0 |

| 1 | 20 | 50 |

| 2 | 20 | 50 |

| 3 | 90 | 50 |

| 4 | 90 | 50 |

| ... | ... | ... |

| 47 | 90 | 50 |

Which of the following statements is NOT correct? Comparing the two alternatives, being a builder compared to a retail salesperson, the:

Your 18 year old friend is considering what to do with their working life until they retire at age 65. They've sought your advice.

For simplicity, ignore taxes and assume that wages will be paid annually in arrears and will be constant (zero growth). The abbreviation 'k' (Greek kilo) means thousands, so 1k is 1000.

Let the present be time zero (t=0) and the year of retirement is time 47 (t=47).

Your friend is deciding between:

- Studying at university for 3 years, costing $30k at the start of each year (3 cash outflows at t=0, 1 & 2), then beginning work as a financial planner for $100k pa (44 annual payments from t=4 to 47 inclusive);

- Working as a builder's apprentice for 2 years, earning $20k pa (2 cash inflows at t=1 and t=2), then beginning work as a builder for $90k pa (45 annual payments from t=3 to 47 inclusive);

You estimate that the required return is 5% pa with either career, and that they're equally risky. The cashflows are shown below:

| Career Choices and Cash Flows | ||

| Time | Planner | Builder |

| 0 | -30 | 0 |

| 1 | -30 | 20 |

| 2 | -30 | 20 |

| 3 | 0 | 90 |

| 4 | 100 | 90 |

| ... | ... | ... |

| 47 | 100 | 90 |

Which of the following statements is NOT correct? Comparing the two alternatives, being a financial planner compared to a builder, the: