Question 722 mean and median returns, return distribution, arithmetic and geometric averages, continuously compounding rate

Here is a table of stock prices and returns. Which of the statements below the table is NOT correct?

| Price and Return Population Statistics | ||||

| Time | Prices | LGDR | GDR | NDR |

| 0 | 100 | |||

| 1 | 50 | -0.6931 | 0.5 | -0.5 |

| 2 | 100 | 0.6931 | 2 | 1 |

| Arithmetic average | 0 | 1.25 | 0.25 | |

| Arithmetic standard deviation | 0.9802 | 1.0607 | 1.0607 | |

Question 721 mean and median returns, return distribution, arithmetic and geometric averages, continuously compounding rate

Fred owns some Commonwealth Bank (CBA) shares. He has calculated CBA’s monthly returns for each month in the past 20 years using this formula:

rt monthly=ln(PtPt−1)He then took the arithmetic average and found it to be 1% per month using this formula:

ˉrmonthly=T∑t=1(rt monthly)T=0.01=1% per monthHe also found the standard deviation of these monthly returns which was 5% per month:

σmonthly=T∑t=1((rt monthly−ˉrmonthly)2)T=0.05=5% per monthWhich of the below statements about Fred’s CBA shares is NOT correct? Assume that the past historical average return is the true population average of future expected returns.

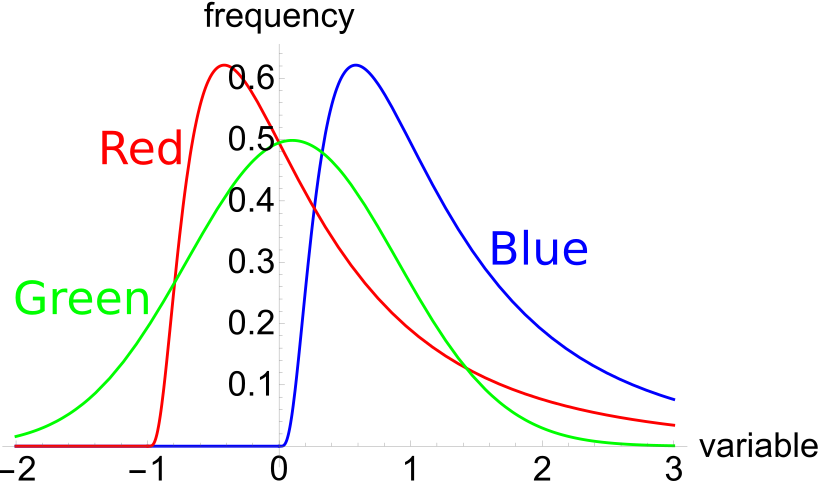

The below three graphs show probability density functions (PDF) of three different random variables Red, Green and Blue. Let P1 be the unknown price of a stock in one year. P1 is a random variable. Let P0=1, so the share price now is $1. This one dollar is a constant, it is not a variable.

Which of the below statements is NOT correct? Financial practitioners commonly assume that the shape of the PDF represented in the colour:

A $100 stock has a continuously compounded expected total return of 10% pa. Its dividend yield is 2% pa with continuous compounding. What do you expect its price to be in 2.5 years?

An equity index is currently at 5,200 points. The 6 month futures price is 5,300 points and the total required return is 6% pa with continuous compounding. Each index point is worth $25.

What is the implied dividend yield as a continuously compounded rate per annum?

A 2-year futures contract on a stock paying a continuous dividend yield of 3% pa was bought when the underlying stock price was $10 and the risk free rate was 10% per annum with continuous compounding. Assume that investors are risk-neutral, so the stock's total required return is the risk free rate.

Find the forward price (F2) and value of the contract (V0) initially. Also find the value of the contract in 6 months (V0.5) if the stock price rose to $12.

A company conducts a 4 for 3 stock split. What is the percentage change in the stock price and the number of shares outstanding? The answers are given in the same order.

A company advertises an investment costing $1,000 which they say is underpriced. They say that it has an expected total return of 15% pa, but a required return of only 10% pa. Assume that there are no dividend payments so the entire 15% total return is all capital return.

Assuming that the company's statements are correct, what is the NPV of buying the investment if the 15% return lasts for the next 100 years (t=0 to 100), then reverts to 10% pa after that time? Also, what is the NPV of the investment if the 15% return lasts forever?

In both cases, assume that the required return of 10% remains constant. All returns are given as effective annual rates.

The answer choices below are given in the same order (15% for 100 years, and 15% forever):

A young lady is trying to decide if she should attend university or begin working straight away in her home town.

The young lady's grandma says that she should not go to university because she is less likely to marry the local village boy whom she likes because she will spend less time with him if she attends university.

What's the correct way to classify this item from a capital budgeting perspective when trying to decide whether to attend university?

The cost of not marrying the local village boy should be classified as:

Which of the following is NOT a valid method to estimate future revenues or costs in a pro-forma income statement when trying to value a company?

Which of the following statements about short-selling is NOT true?

What is the covariance of a variable X with itself?

The cov(X, X) or σX,X equals:

Let the variance of returns for a share per month be σ2monthly.

What is the formula for the variance of the share's returns per year (σ2yearly)?

Assume that returns are independently and identically distributed (iid) so they have zero auto correlation, meaning that if the return was higher than average today, it does not indicate that the return tomorrow will be higher or lower than average.

Diversification in a portfolio of two assets works best when the correlation between their returns is:

Let the standard deviation of returns for a share per month be σmonthly.

What is the formula for the standard deviation of the share's returns per year (σyearly)?

Assume that returns are independently and identically distributed (iid) so they have zero auto correlation, meaning that if the return was higher than average today, it does not indicate that the return tomorrow will be higher or lower than average.

What is the correlation of a variable X with a constant C?

The corr(X, C) or ρX,C equals:

Stock A and B's returns have a correlation of 0.3. Which statement is NOT correct?

Question 408 leverage, portfolio beta, portfolio risk, real estate, CAPM

You just bought a house worth $1,000,000. You financed it with an $800,000 mortgage loan and a deposit of $200,000.

You estimate that:

- The house has a beta of 1;

- The mortgage loan has a beta of 0.2.

What is the beta of the equity (the $200,000 deposit) that you have in your house?

Also, if the risk free rate is 5% pa and the market portfolio's return is 10% pa, what is the expected return on equity in your house? Ignore taxes, assume that all cash flows (interest payments and rent) were paid and received at the end of the year, and all rates are effective annual rates.

Three important classes of investable risky assets are:

- Corporate debt which has low total risk,

- Real estate which has medium total risk,

- Equity which has high total risk.

Assume that the correlation between total returns on:

- Corporate debt and real estate is 0.1,

- Corporate debt and equity is 0.1,

- Real estate and equity is 0.5.

You are considering investing all of your wealth in one or more of these asset classes. Which portfolio will give the lowest total risk? You are restricted from shorting any of these assets. Disregard returns and the risk-return trade-off, pretend that you are only concerned with minimising risk.

The covariance and correlation of two stocks X and Y's annual returns are calculated over a number of years. The units of the returns are in percent per annum (%pa).

What are the units of the covariance (σX,Y) and correlation (ρX,Y) of returns respectively?

Hint: Visit Wikipedia to understand the difference between percentage points (pp) and percent (%).

Treasury bonds currently have a return of 5% pa. A stock has a beta of 0.5 and the market return is 10% pa. What is the expected return of the stock?

A stock's total standard deviation of returns is 20% pa. The market portfolio's total standard deviation of returns is 15% pa. The beta of the stock is 0.8.

What is the stock's diversifiable standard deviation?

Question 271 CAPM, option, risk, systematic risk, systematic and idiosyncratic risk

All things remaining equal, according to the capital asset pricing model, if the systematic variance of an asset increases, its required return will increase and its price will decrease.

If the idiosyncratic variance of an asset increases, its price will be unchanged.

What is the relationship between the price of a call or put option and the total, systematic and idiosyncratic variance of the underlying asset that the option is based on? Select the most correct answer.

Call and put option prices increase when the:

Question 104 CAPM, payout policy, capital structure, Miller and Modigliani, risk

Assume that there exists a perfect world with no transaction costs, no asymmetric information, no taxes, no agency costs, equal borrowing rates for corporations and individual investors, the ability to short the risk free asset, semi-strong form efficient markets, the CAPM holds, investors are rational and risk-averse and there are no other market frictions.

For a firm operating in this perfect world, which statement(s) are correct?

(i) When a firm changes its capital structure and/or payout policy, share holders' wealth is unaffected.

(ii) When the idiosyncratic risk of a firm's assets increases, share holders do not expect higher returns.

(iii) When the systematic risk of a firm's assets increases, share holders do not expect higher returns.

Select the most correct response:

Question 624 franking credit, personal tax on dividends, imputation tax system, no explanation

Which of the following statements about Australian franking credits is NOT correct? Franking credits:

Question 469 franking credit, personal tax on dividends, imputation tax system, no explanation

A firm pays a fully franked cash dividend of $70 to one of its Australian shareholders who has a personal marginal tax rate of 45%. The corporate tax rate is 30%.

What will be the shareholder's personal tax payable due to the dividend payment?

A company announces that it will pay a dividend, as the market expected. The company's shares trade on the stock exchange which is open from 10am in the morning to 4pm in the afternoon each weekday. When would the share price be expected to fall by the amount of the dividend? Ignore taxes.

The share price is expected to fall during the:

Currently, a mining company has a share price of $6 and pays constant annual dividends of $0.50. The next dividend will be paid in 1 year. Suddenly and unexpectedly the mining company announces that due to higher than expected profits, all of these windfall profits will be paid as a special dividend of $0.30 in 1 year.

If investors believe that the windfall profits and dividend is a one-off event, what will be the new share price? If investors believe that the additional dividend is actually permanent and will continue to be paid, what will be the new share price? Assume that the required return on equity is unchanged. Choose from the following, where the first share price includes the one-off increase in earnings and dividends for the first year only (P0 one-off) , and the second assumes that the increase is permanent (P0 permanent):

Note: When a firm makes excess profits they sometimes pay them out as special dividends. Special dividends are just like ordinary dividends but they are one-off and investors do not expect them to continue, unlike ordinary dividends which are expected to persist.

Interest expense (IntExp) is an important part of a company's income statement (or 'profit and loss' or 'statement of financial performance').

How does an accountant calculate the annual interest expense of a fixed-coupon bond that has a liquid secondary market? Select the most correct answer:

Annual interest expense is equal to:

Question 337 capital structure, interest tax shield, leverage, real and nominal returns and cash flows, multi stage growth model

A fast-growing firm is suitable for valuation using a multi-stage growth model.

It's nominal unlevered cash flow from assets (CFFAU) at the end of this year (t=1) is expected to be $1 million. After that it is expected to grow at a rate of:

- 12% pa for the next two years (from t=1 to 3),

- 5% over the fourth year (from t=3 to 4), and

- -1% forever after that (from t=4 onwards). Note that this is a negative one percent growth rate.

Assume that:

- The nominal WACC after tax is 9.5% pa and is not expected to change.

- The nominal WACC before tax is 10% pa and is not expected to change.

- The firm has a target debt-to-equity ratio that it plans to maintain.

- The inflation rate is 3% pa.

- All rates are given as nominal effective annual rates.

What is the levered value of this fast growing firm's assets?

Question 69 interest tax shield, capital structure, leverage, WACC

Which statement about risk, required return and capital structure is the most correct?

Question 99 capital structure, interest tax shield, Miller and Modigliani, trade off theory of capital structure

A firm changes its capital structure by issuing a large amount of debt and using the funds to repurchase shares. Its assets are unchanged.

Assume that:

- The firm and individual investors can borrow at the same rate and have the same tax rates.

- The firm's debt and shares are fairly priced and the shares are repurchased at the market price, not at a premium.

- There are no market frictions relating to debt such as asymmetric information or transaction costs.

- Shareholders wealth is measured in terms of utiliity. Shareholders are wealth-maximising and risk-averse. They have a preferred level of overall leverage. Before the firm's capital restructure all shareholders were optimally levered.

According to Miller and Modigliani's theory, which statement is correct?

Question 397 financial distress, leverage, capital structure, NPV

A levered firm has a market value of assets of $10m. Its debt is all comprised of zero-coupon bonds which mature in one year and have a combined face value of $9.9m.

Investors are risk-neutral and therefore all debt and equity holders demand the same required return of 10% pa.

Therefore the current market capitalisation of debt (D0) is $9m and equity (E0) is $1m.

A new project presents itself which requires an investment of $2m and will provide a:

- $6.6m cash flow with probability 0.5 in the good state of the world, and a

- -$4.4m (notice the negative sign) cash flow with probability 0.5 in the bad state of the world.

The project can be funded using the company's excess cash, no debt or equity raisings are required.

What would be the new market capitalisation of equity (E0, with project) if shareholders vote to proceed with the project, and therefore should shareholders proceed with the project?

Question 398 financial distress, capital raising, leverage, capital structure, NPV

A levered firm has zero-coupon bonds which mature in one year and have a combined face value of $9.9m.

Investors are risk-neutral and therefore all debt and equity holders demand the same required return of 10% pa.

In one year the firm's assets will be worth:

- $13.2m with probability 0.5 in the good state of the world, or

- $6.6m with probability 0.5 in the bad state of the world.

A new project presents itself which requires an investment of $2m and will provide a certain cash flow of $3.3m in one year.

The firm doesn't have any excess cash to make the initial $2m investment, but the funds can be raised from shareholders through a fairly priced rights issue. Ignore all transaction costs.

Should shareholders vote to proceed with the project and equity raising? What will be the gain in shareholder wealth if they decide to proceed?

Question 740 real and nominal returns and cash flows, DDM, inflation

Taking inflation into account when using the DDM can be hard. Which of the following formulas will NOT give a company's current stock price (P0)? Assume that the annual dividend was just paid (C0), and the next dividend will be paid in one year (C1).

Question 742 price gains and returns over time, no explanation

For an asset's price to quintuple (be five times as big, say from $1 to $5) every 5 years, what must be its effective annual capital return?

Question 542 price gains and returns over time, IRR, NPV, income and capital returns, effective return

For an asset price to double every 10 years, what must be the expected future capital return, given as an effective annual rate?

A firm has a debt-to-assets ratio of 20%. What is its debt-to-equity ratio?

Let the 'income return' of a bond be the coupon at the end of the period divided by the market price now at the start of the period (C1/P0). The expected income return of a premium fixed coupon bond is:

Mr Blue, Miss Red and Mrs Green are people with different utility functions.

Which of the following statements is NOT correct?

What is the Internal Rate of Return (IRR) of the project detailed in the table below?

Assume that the cash flows shown in the table are paid all at once at the given point in time. All answers are given as effective annual rates.

| Project Cash Flows | |

| Time (yrs) | Cash flow ($) |

| 0 | -100 |

| 1 | 0 |

| 2 | 121 |